Market Update: June 2023

At the start of the year, the market outlook was very pessimistic. In fact it was the most conservative RRSP season ever in Canada. And what happened? Markets surprised to the upside and have done very well, especially technology companies.

Why did that happen? The economy has been better than expected. The government’s money out during covid strengthened the finances of consumers especially in the US. You may have heard never bet against the US consumer.

What is the lesson? Markets do what markets do, so we need to set our plans up to meet our goals, within our own time frame, which is what we do. Another reminder (or lesson for those that haven’t learned it yet) is that markets are very difficult to time. No one can figure that out.

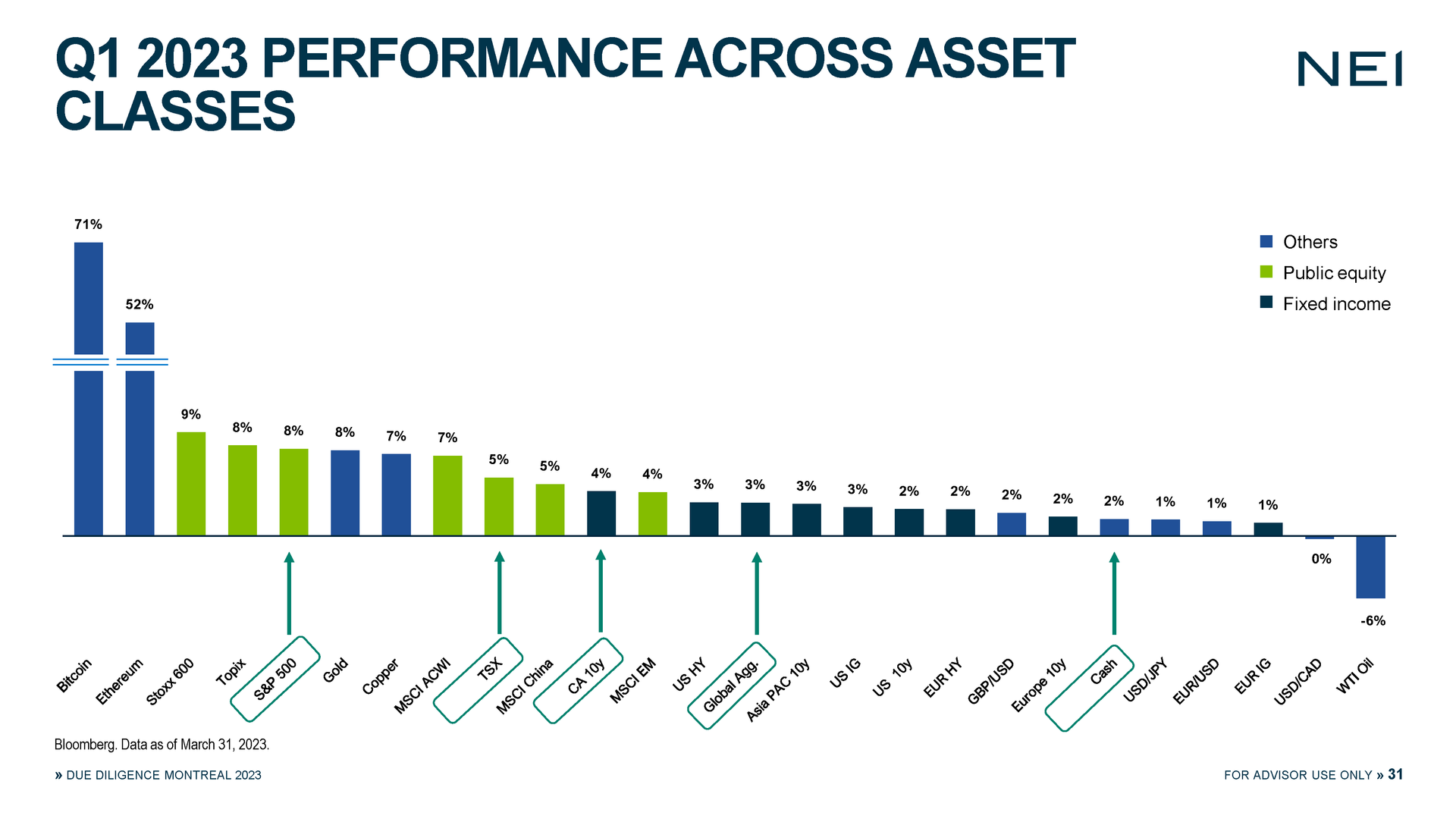

Here is a chart showing performance by asset classes to the end of March 31, 2023

It is almost silly to make predictions that are bound to be wrong, but I’ll say them anyways. There is still a concern about recession although it continues to get pushed back. No one knows for sure. And markets are forward looking and price in their future expectations.

Inflation is moderating which is great news It was fairly easy to go from 8% to 4%, but it will be more difficult to go from 4% back to 2%. As a result Central Banks are likely near the end of their increasing rate cycles. It’s possible interest rates could start to be reduced by the end of the year, although no one knows for sure and most expect into 2024.

The latest forecast from Goldman Sachs predicts the S&P 500 to be up a bit more by year end, so we will hope they are correct. In the meantime we invest in a variety of asset classes, across different geographies and investments to minimize our risks and take advantage of opportunities.

Source: NEI Investments.com

Here are the latest market numbers to June 15:

| S&P 500 (US) | 15.36% |

|---|---|

| TSX (Canada) | 3.36% |