Wow, things took a turn quickly, didn't they?

It’s been a rocky few weeks.

There’s been more recent volatility in the markets, that we haven’t seen a lot of in 2024, but this it is normal.

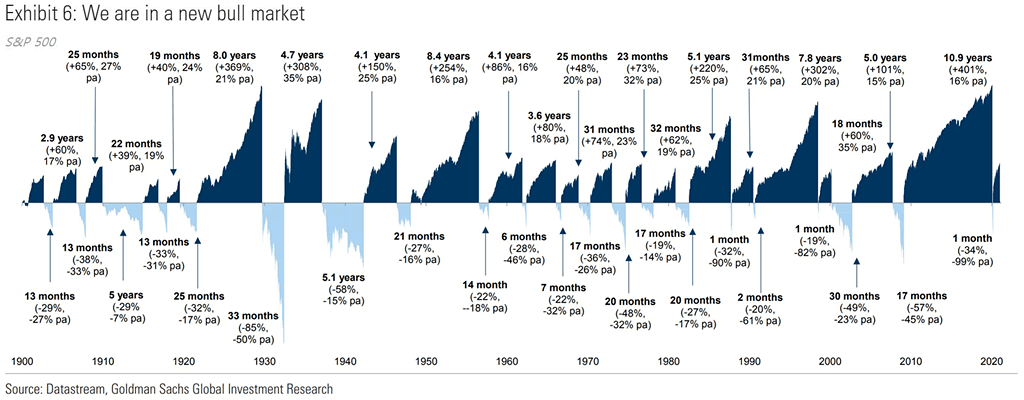

If you look at this chart from 1929 to now, most of the time markets are going up (bull market), but we do have occasional down ones

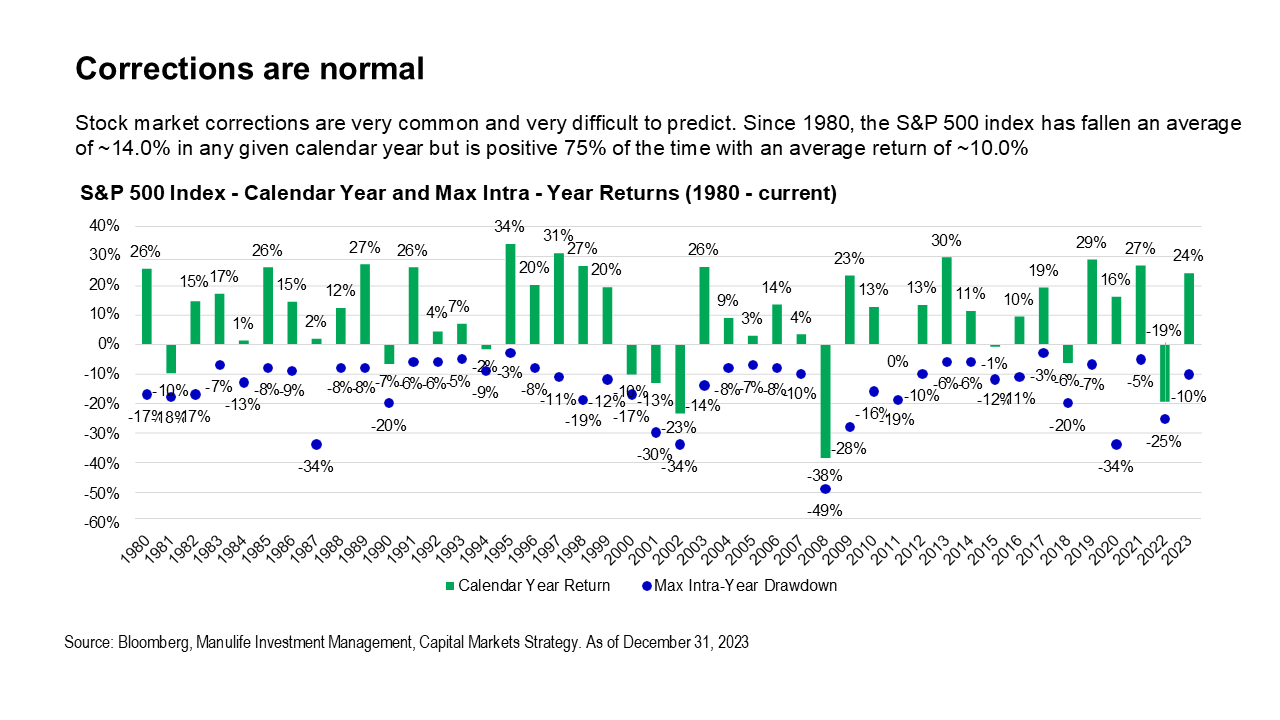

Every year there typically there is a sell off in the market, but 75% of the time markets turn out positive.

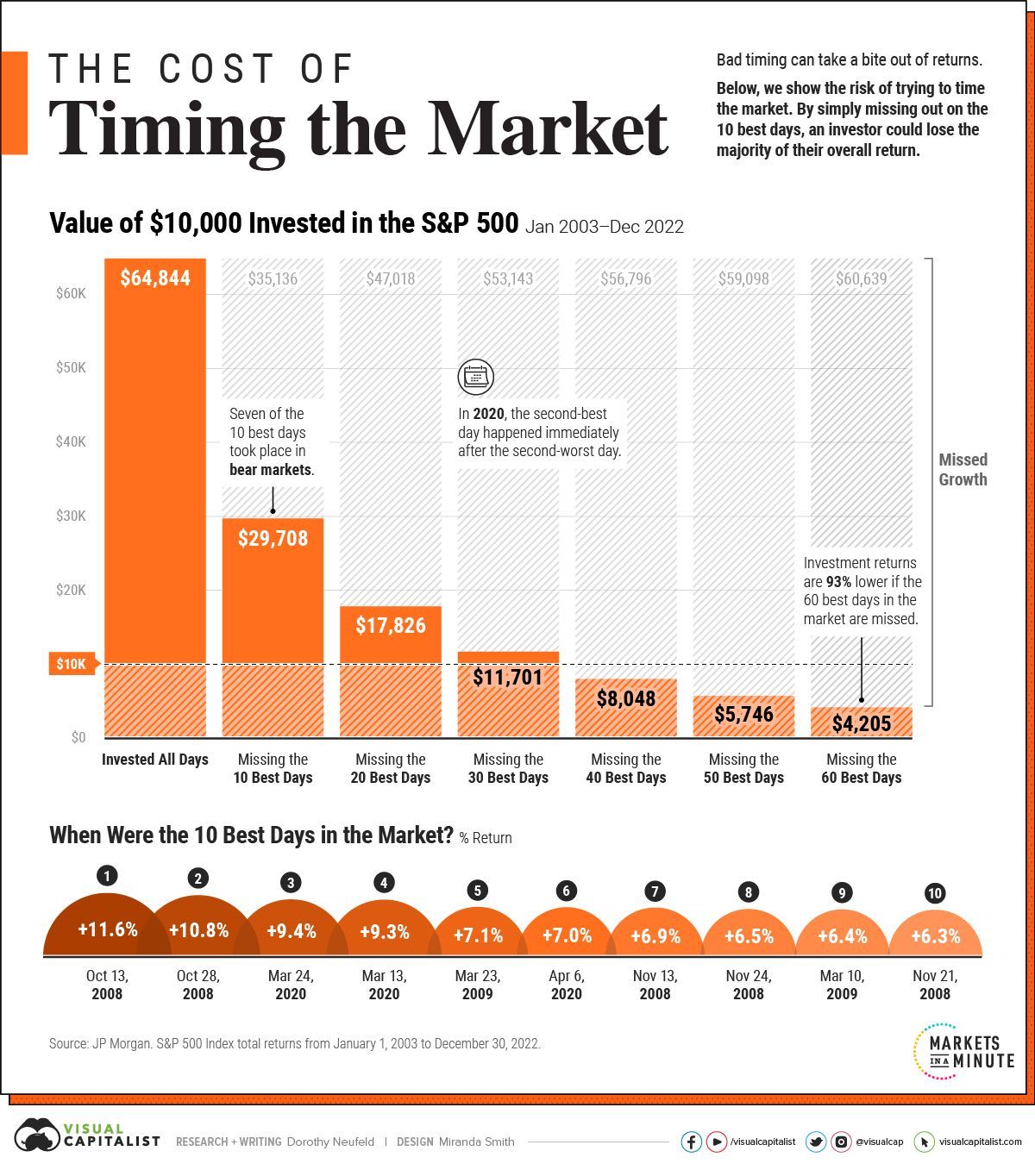

The best thing to do, as long as you have good investments is to stay the course, because literally no one can time the market.

And if you miss a few good days, you miss out hugely on returns.

We are focused on qualify consistent investments. And the market does periodically seem illogical but over the long term, good companies go up in value.

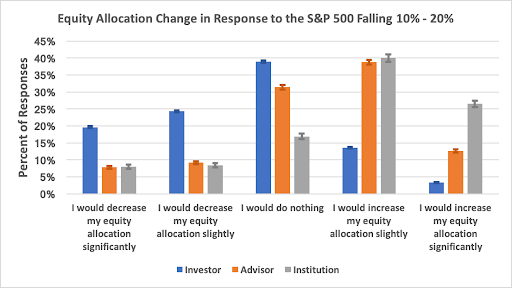

You can see that during market dips, smart investors such as institutions i.e. Canada Pension plan would increase their stock holdings, which is the opposite of what individual investors might do.

And who has the better track record?

Please reach out if you have any questions

Source:

https://fmgsuite.com/insights

https://www.visualcapitalist.com/chart-timing-the-market/

https://www.goldmansachs.com/

https://www.bloomberg.com/