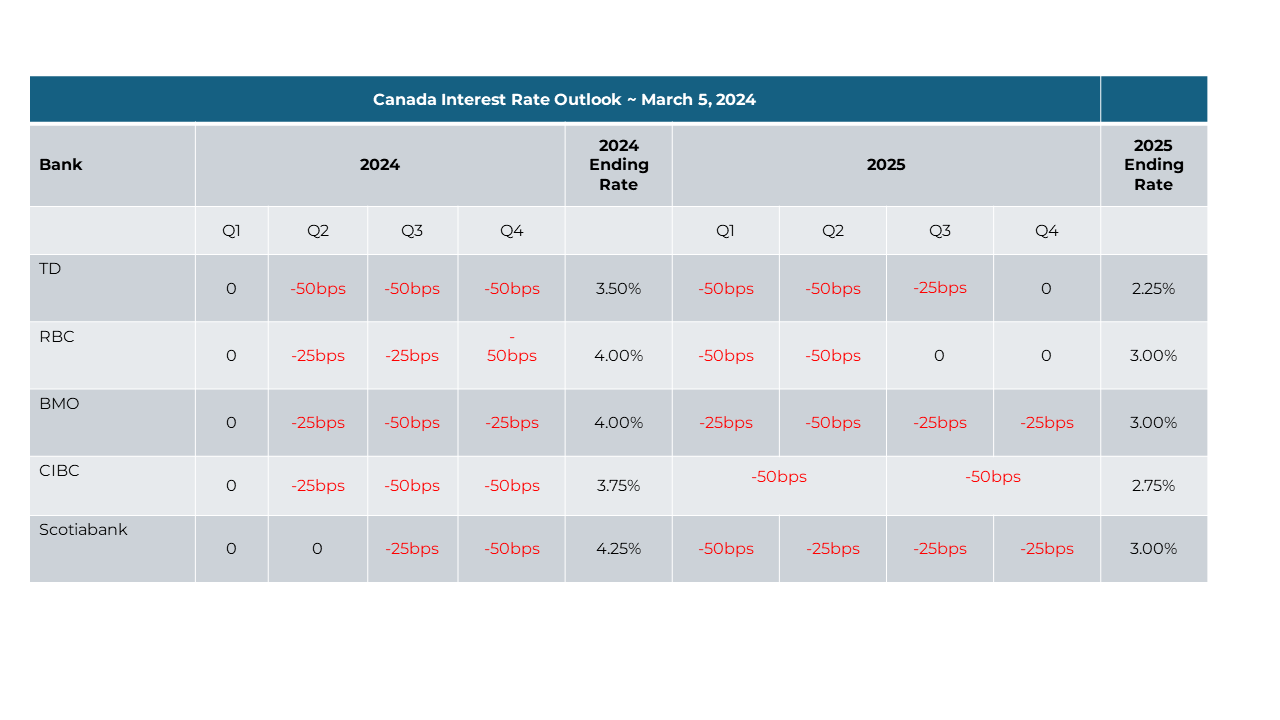

What are the 5 big banks predicting for interest rate cuts for 2024?

Canada Interest Rate Outlook- March 2024:

Here are the latest interest rate cut predictions from the big 5 Canadian banks. I think it’s interesting to see. If you have a mortgage, you’ll be hoping these interest rate cuts happen sooner than later. If you have money in savings, you’d prefer rates stay high!

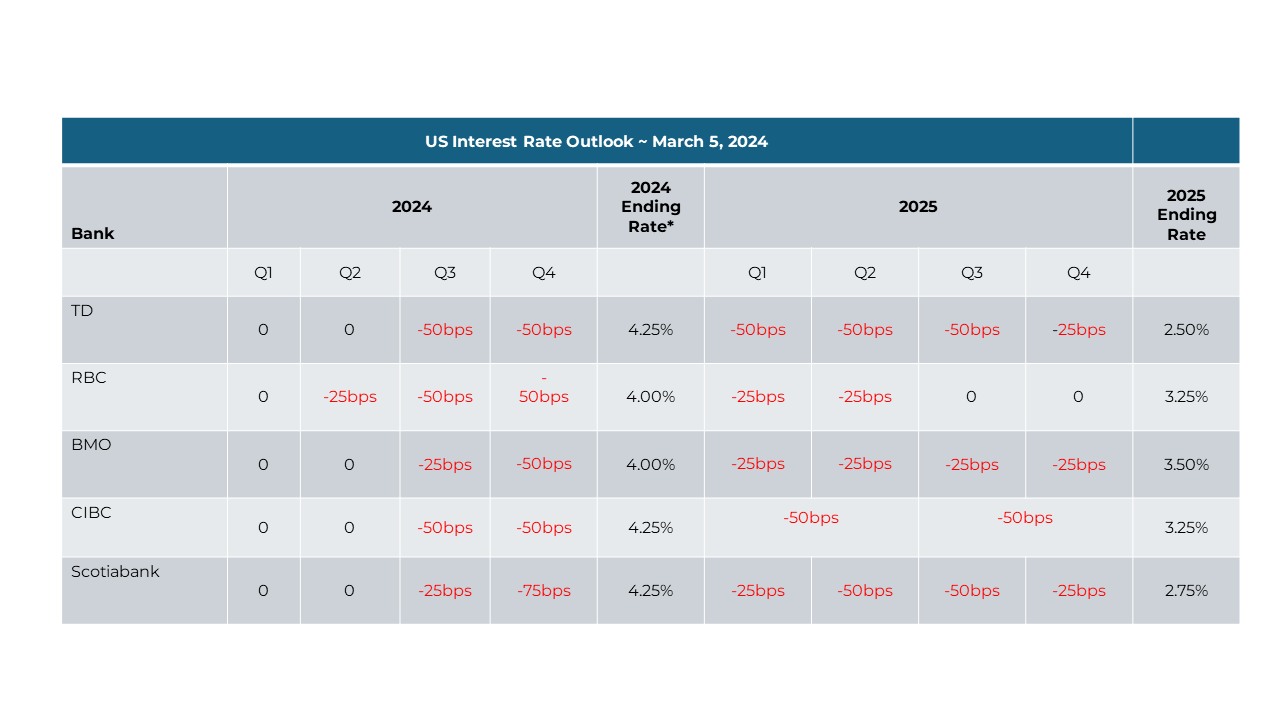

*Lower Bound of the US Federal Reserve Target Rate, Upper Bound +25bps

Sources: most recent update: TD Economics (January 22, 2024), RBC Economics (Febraury, 2024), BMO Economics (March 1, 2024), CIBC Economics (Febraury 15, 2024), Scotiabank (Febraury 6, 2024)

Stock Market Highlights:

· Despite a mid-month dip sparked by higher-than-anticipated U.S. Inflation figures for January, which tempered expectations for rate cuts, U.S., Canadian, and global equities rallied to mark their fourth consecutive month of gains.

· Nvidia, a leading AI chipmaker and a significant player in the tech sector, announced stellar results for Q4 2023, igniting a global equity rally.

· The U.S. economy added a remarkable 353,000 new jobs in January, with the unemployment rate dropping to 3.7%. However, the uptick in average hourly earnings raised concerns about inflationary pressures, potentially delaying anticipated rate cuts.

· China's central bank implemented an unprecedented cut in its five-year loan prime rate, from 4.2% to 3.95%, aimed at revitalizing the real estate market and reducing mortgage costs to stimulate demand.

· The International Monetary Fund (IMF) released optimistic growth forecasts for 2024 and 2025, projecting a global output increase of 3.2%. Notably, Canada's GDP is expected to grow rapidly, ranking third among advanced economies.

· U.S. CPI for January moderated from 3.4% to 3.1%, though still above the Fed’s 2% target, prompting a brief market pullback as rate cut expectations adjusted. However, the Fed's focus on the PCE Index suggests the reaction may have been exaggerated, leading to a swift market recovery.

· Canadian Inflation for January decreased from 3.4% to 2.9%, mainly due to falling gasoline prices. Excluding problematic mortgage interest costs, inflation would stand at 2%, bringing the Bank of Canada closer to considering rate reductions.

Implications for Investments:

· Global equity markets continue to soar to new highs, led by U.S. and Japanese stocks, reflecting strong earnings and economic resilience. However, the rapid pace of these rallies and increasing valuations may introduce near-term volatility.

· Chinese equities have rebounded, driven by regulatory changes and oversight adjustments.

· Regardless of market cycles, maintaining a disciplined investment approach and focusing on long-term goals is key. This approach helps reduce emotional reactions that often lead to detrimental investment decisions.

· Regular monitoring and review of your portfolio ensure alignment with your objectives. Diversifying investments further mitigates risk exposure.

· We're committed to supporting you in achieving your financial goals. Feel free to reach out for personalized guidance and assistance.

Remember, staying disciplined and informed is key to navigating market fluctuations and achieving long-term success in your investment journey.

Sources: most recent update: TD Economics (January 22, 2024), RBC Economics (Febraury, 2024), BMO Economics (March 1, 2024), CIBC Economics (Febraury 15, 2024), Scotiabank (Febraury 6, 2024)