Turning the corner

2022 can be classified as the year of many unexpected negative surprises in the financial markets.

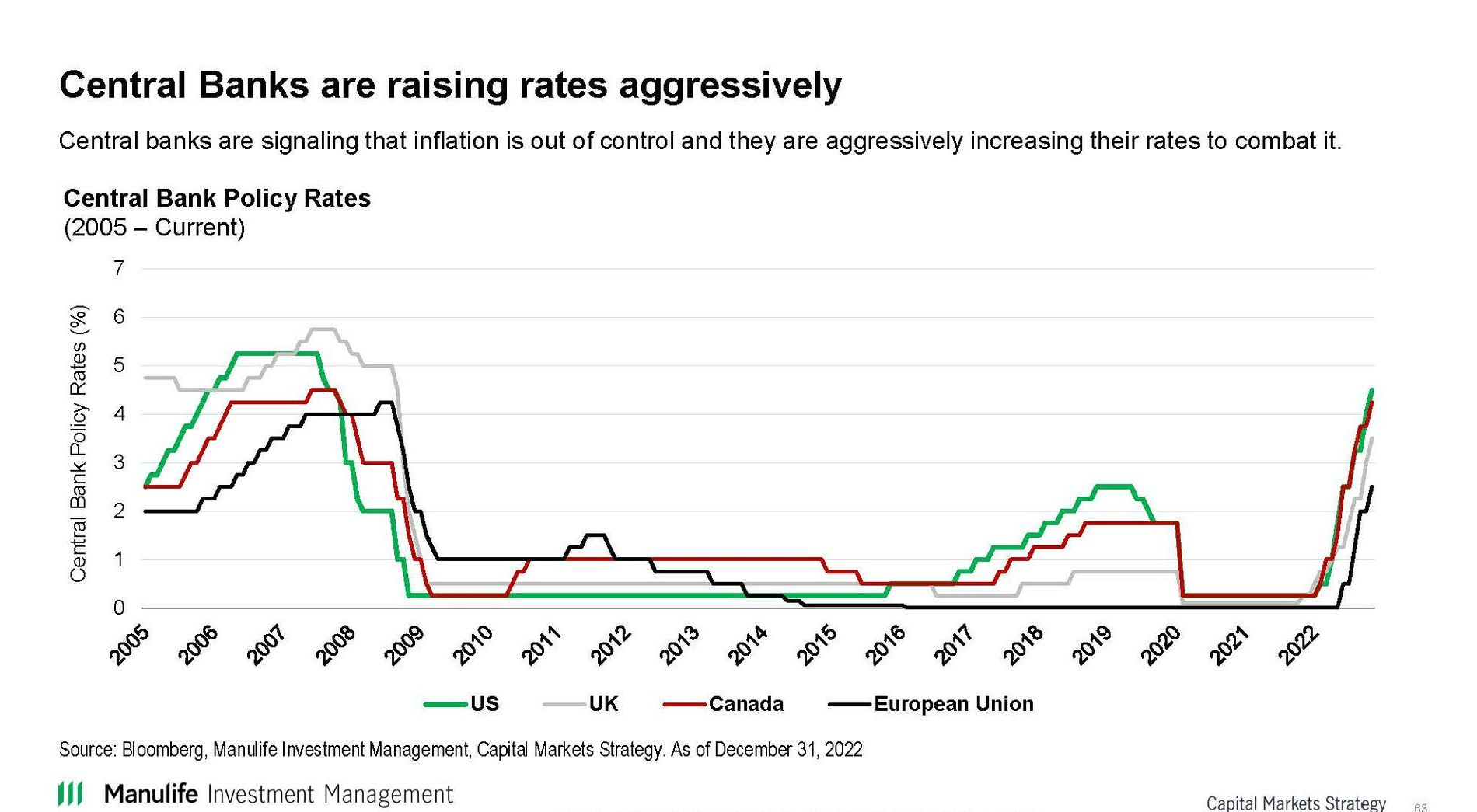

The main surprise was higher stubborn inflation and central banks’ reactions to it. As an example, in the US, it was expected at the start of 2022 that the U.S. Federal Reserve would raise interest rates by approximately 1% at most. But stubbornly higher inflation resulted in an increase to 4.5% by end of year.

This is the fastest tightening of interest rates in 40 years.

Source: Management Investment Management with permission

Secondly, an unexpected conflict in Ukraine in February added fuel to the inflationary fire by impacting energy and food prices.

And finally, China’s ambitious zero-COVID policy resulted in large-scale shutdowns of major city centers—including Shanghai and Beijing, which delayed the full opening of supply chains, negatively impacting global economic growth.

Other than cash, there were very few areas to protect your investments. The S&P 500, S&P/TSX Composite, Nasdaq Composite, and MSCI EAFE Indexes were all down 12.4%, 5.8%, 27.8% and 7.9% respectively, in Canadian Dollars, including dividends.

Global equity, commodity, currency, and yield data

| North America | 2022 |

|---|---|

| S&P/TSX | -8.7% |

| S&P 500 (USD) | -19.4% |

| Dow Jones (USD) | -8.8% |

| Nasdaq (USD) | -33.1% |

| World | 2022 |

| MSCI Europe (USD) | -11.9% |

| MSCI EAFE (USD) | -16.8% |

| December | T - 3 Months | T - 6 Months | T - 1 Year | |

|---|---|---|---|---|

| Canada 10 Year | 3.30 | 3.17 | 3.22 | 1.43 |

| US 10 Year | 3.87 | 3.83 | 3.01 | 1.51 |

| Oil (USD) | 80.26 | 79.49 | 105.76 | 75.21 |

| Gold (USD) | 1826.20 | 1684.90 | 1839.40 | 1843.90 |

| CAN/USD | 0.74 | 0.72 | 0.78 | 0.79 |

| EUR/USD | 1.07 | 0.98 | 1.05 | 1.14 |

Source: Manulife Investments Management

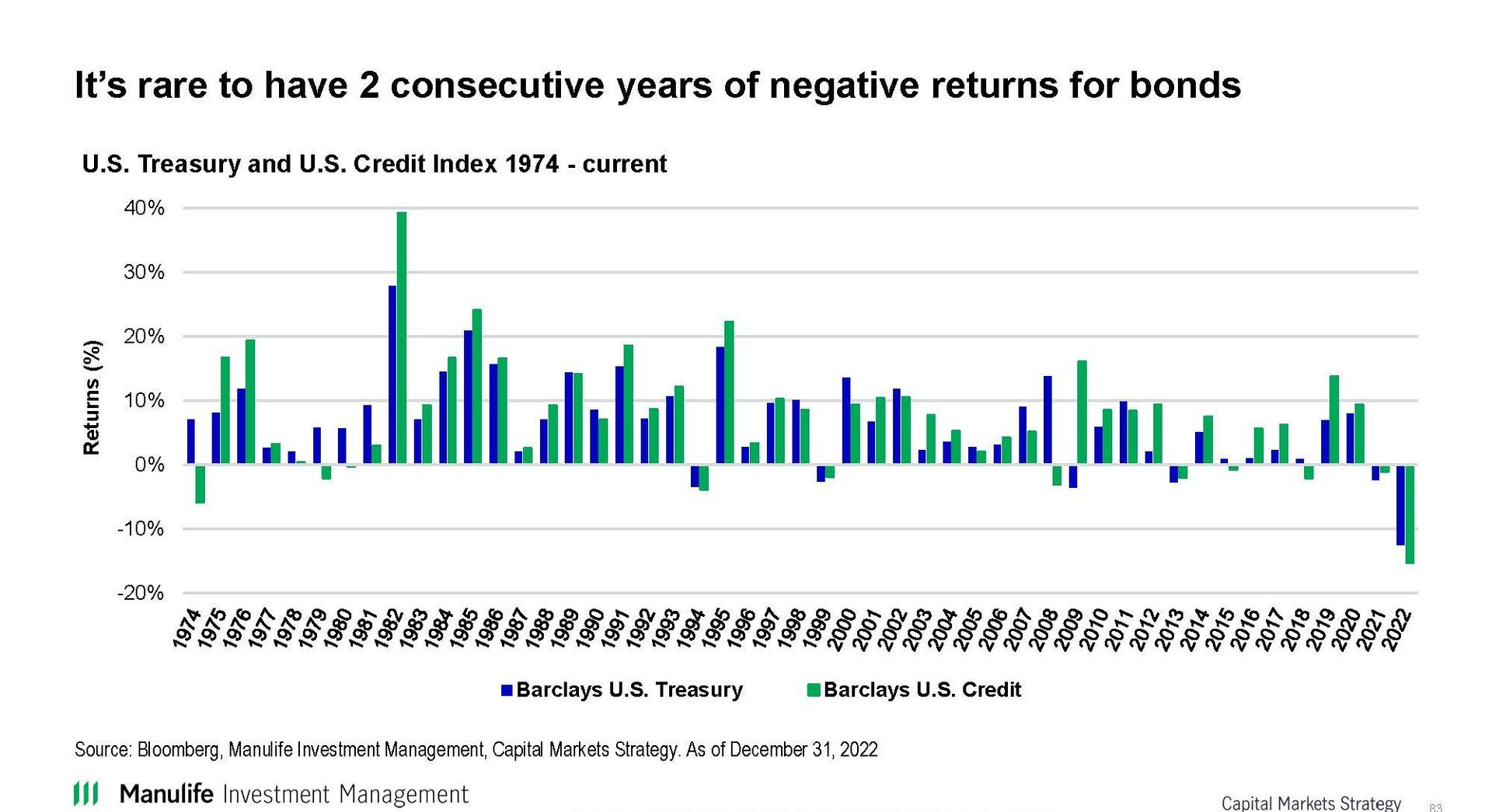

In addition bonds, which typically provide protection when stocks go down, were also negative 11.7%, 13.0% (USD), and 16.3% (USD)* as measured by the FTSE Canada Universe Bond, Bloomberg US Aggregate, and the Bloomberg Global-Aggregate Total Return Indexes.

*Source: www.bloomberg.com

2022 was one for the record books. Since 1926, 2022 has been the only year where the S&P 500 and U.S. Treasuries bonds were both down more than 10%!

Many investors are saying good riddance to 2022. So how do we think 2023 will unfold?

Global Economy

There are continued reasons to think the global economy will continue to slow in 2023 and it is expected there will be a recession in 2023. Will it be mild or severe? The current thought is that it will be mild in the US and might be more severe in Canada and Europe. The reason is that the US labour market is very strong – unemployment is still very low with lots of job openings.

Equity Markets

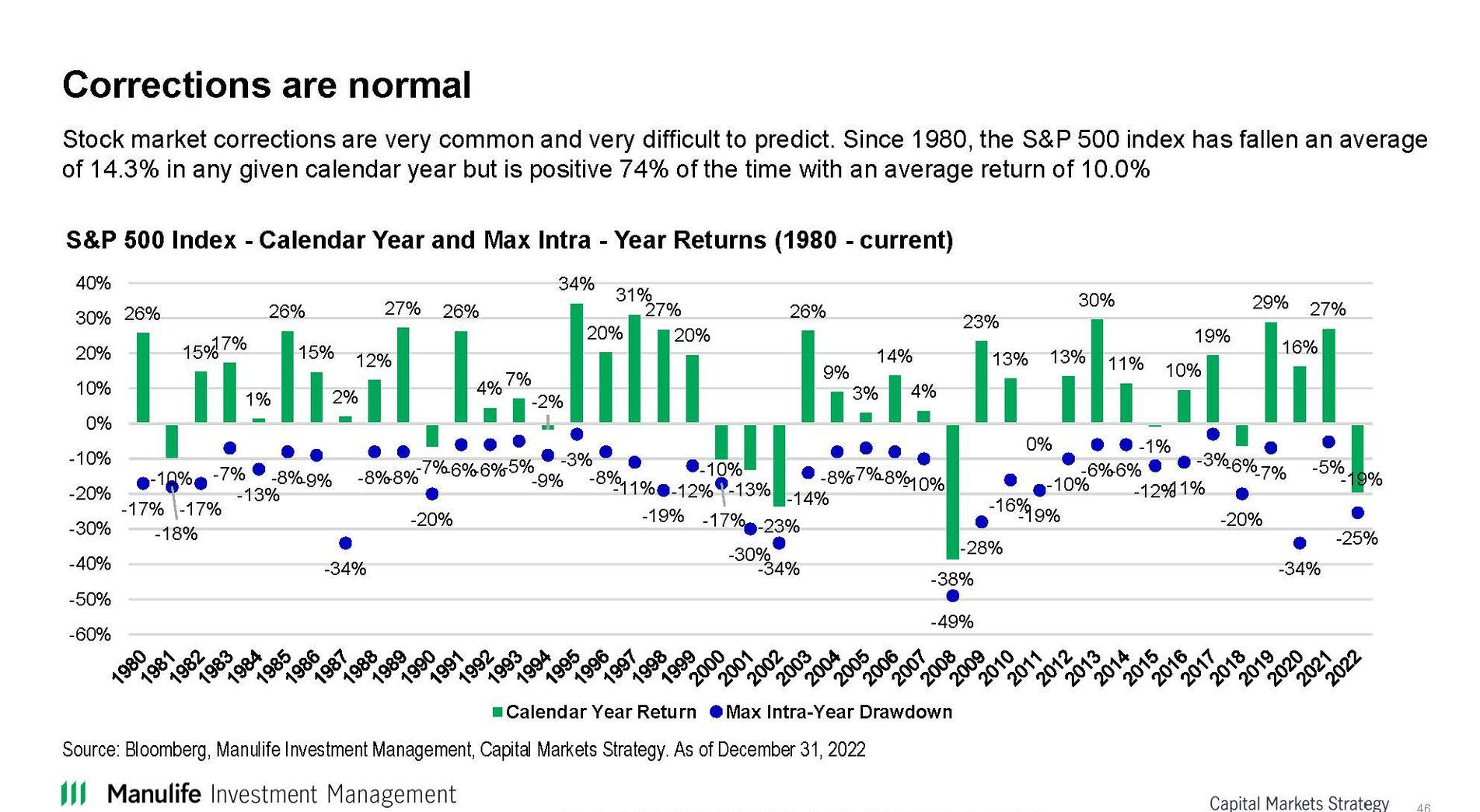

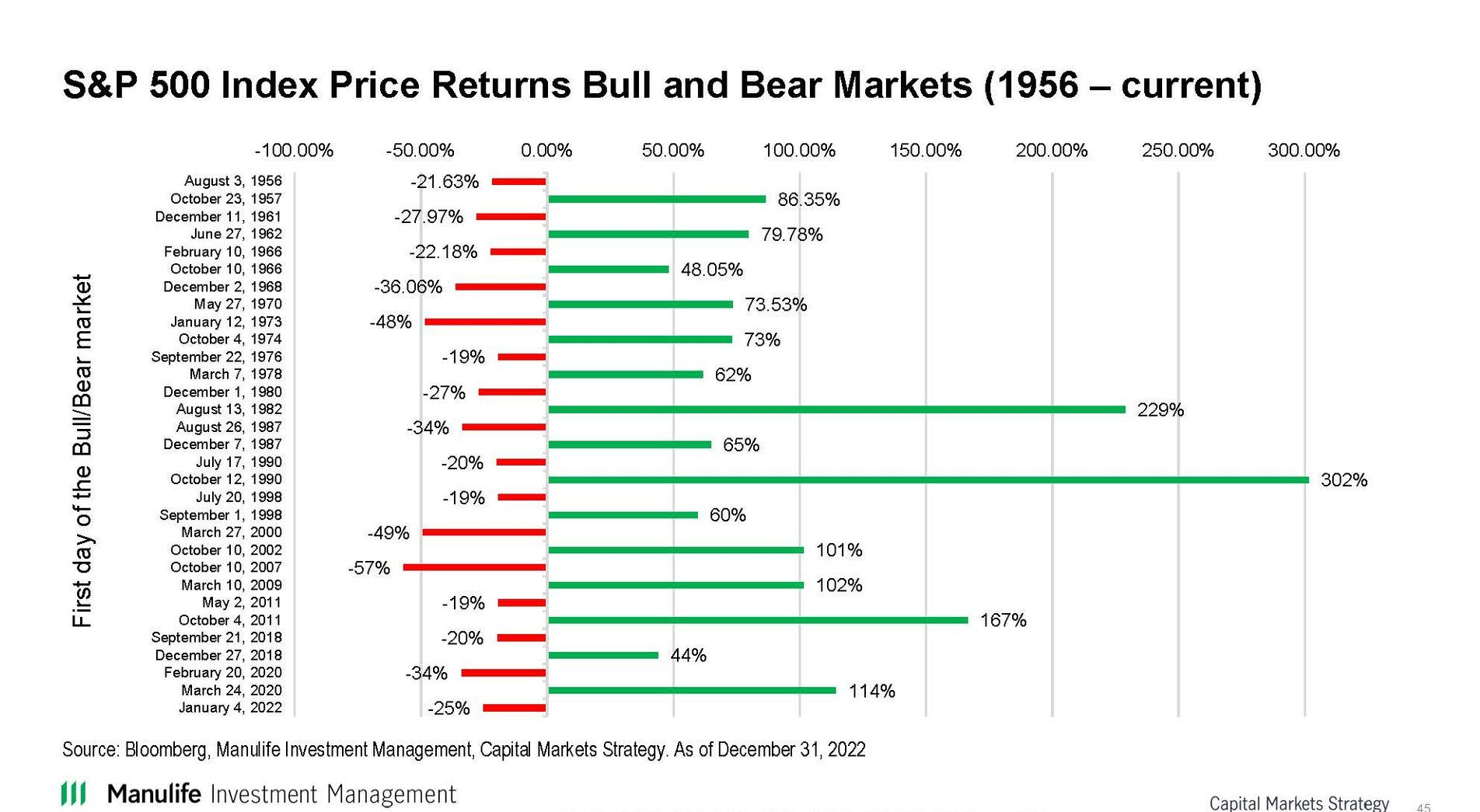

Now that stock prices have gone down so much they are much more in line with their long term averages (see chart below). There will likely be a choppy equity market environment in the short term until there is more clarity about how companies are managing during the economy slowdown.

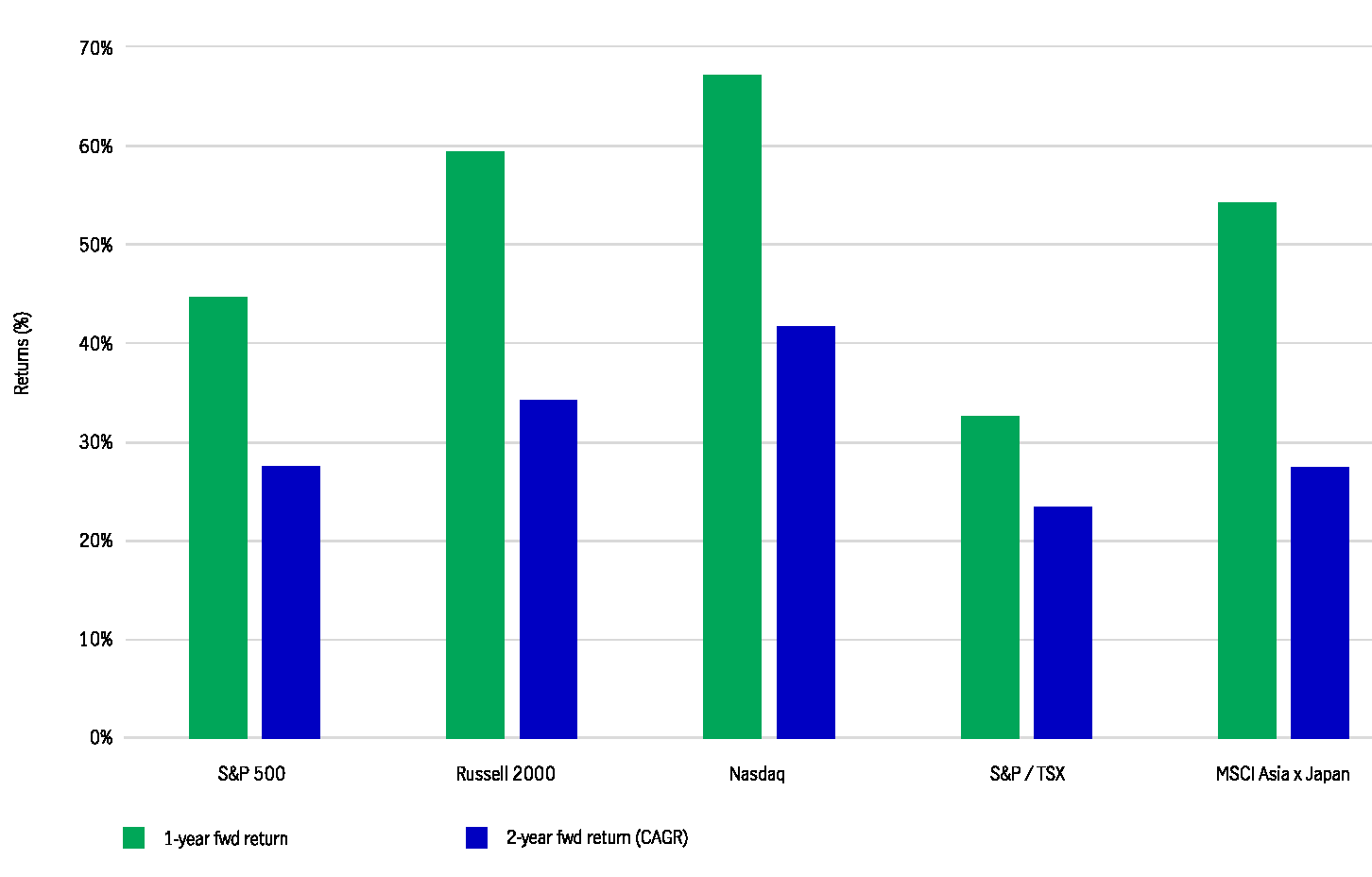

Which investments do better after a bear market? Here is a chart showing 1 and 2 year returns after a market bottom since 1970 and the best performers are companies in the Nasdaq indices and US Mid sized companies.

Source: Manulife Investment Management

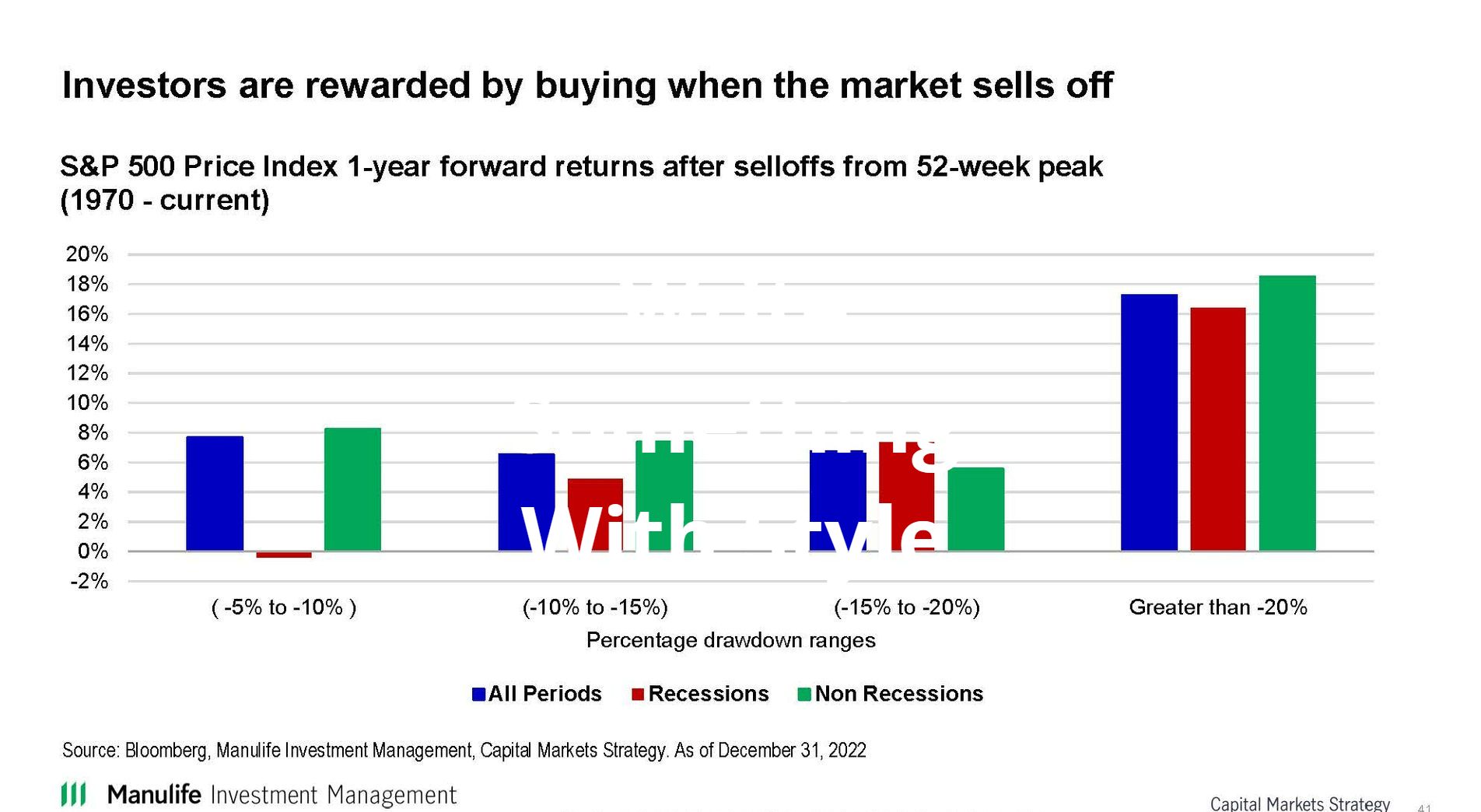

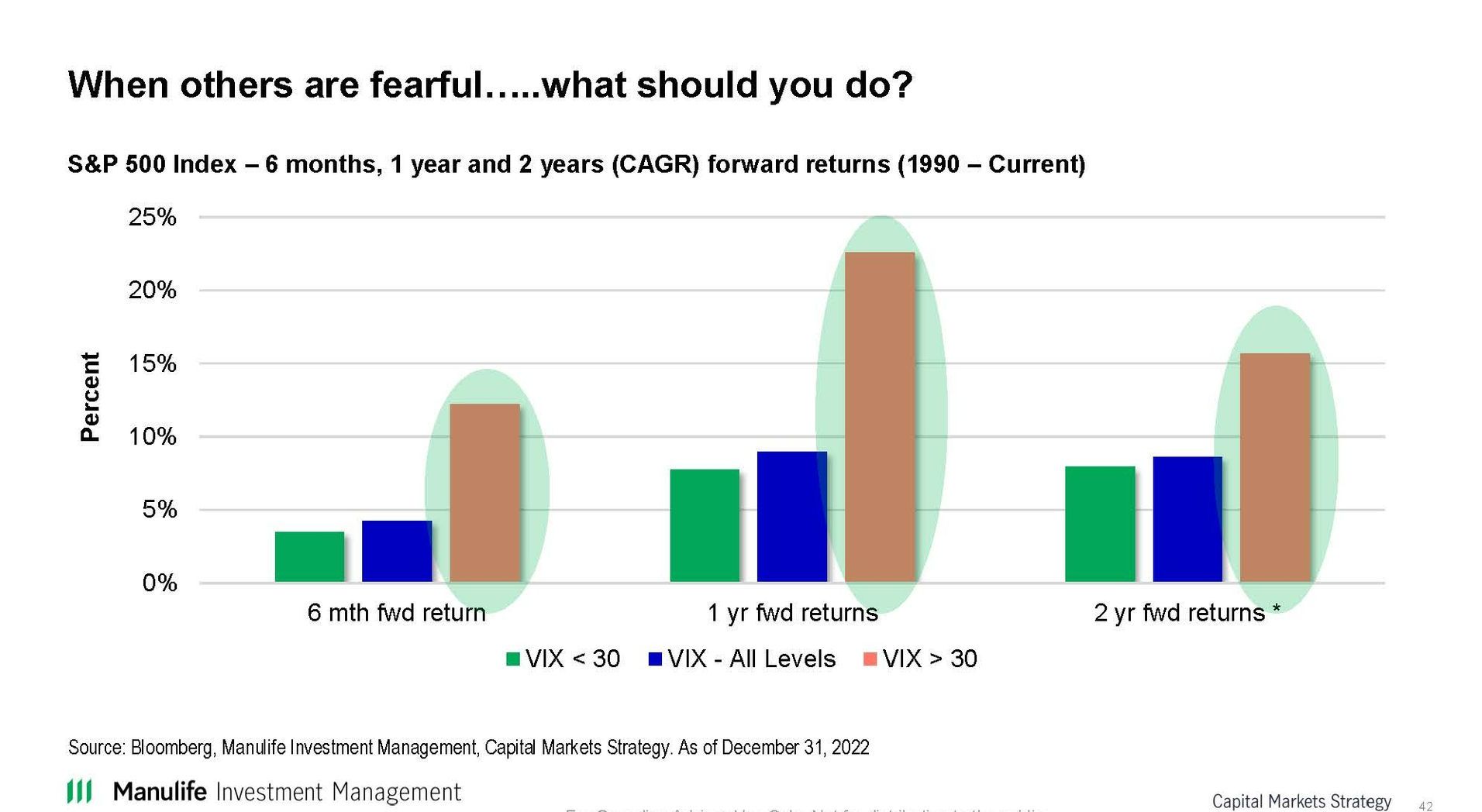

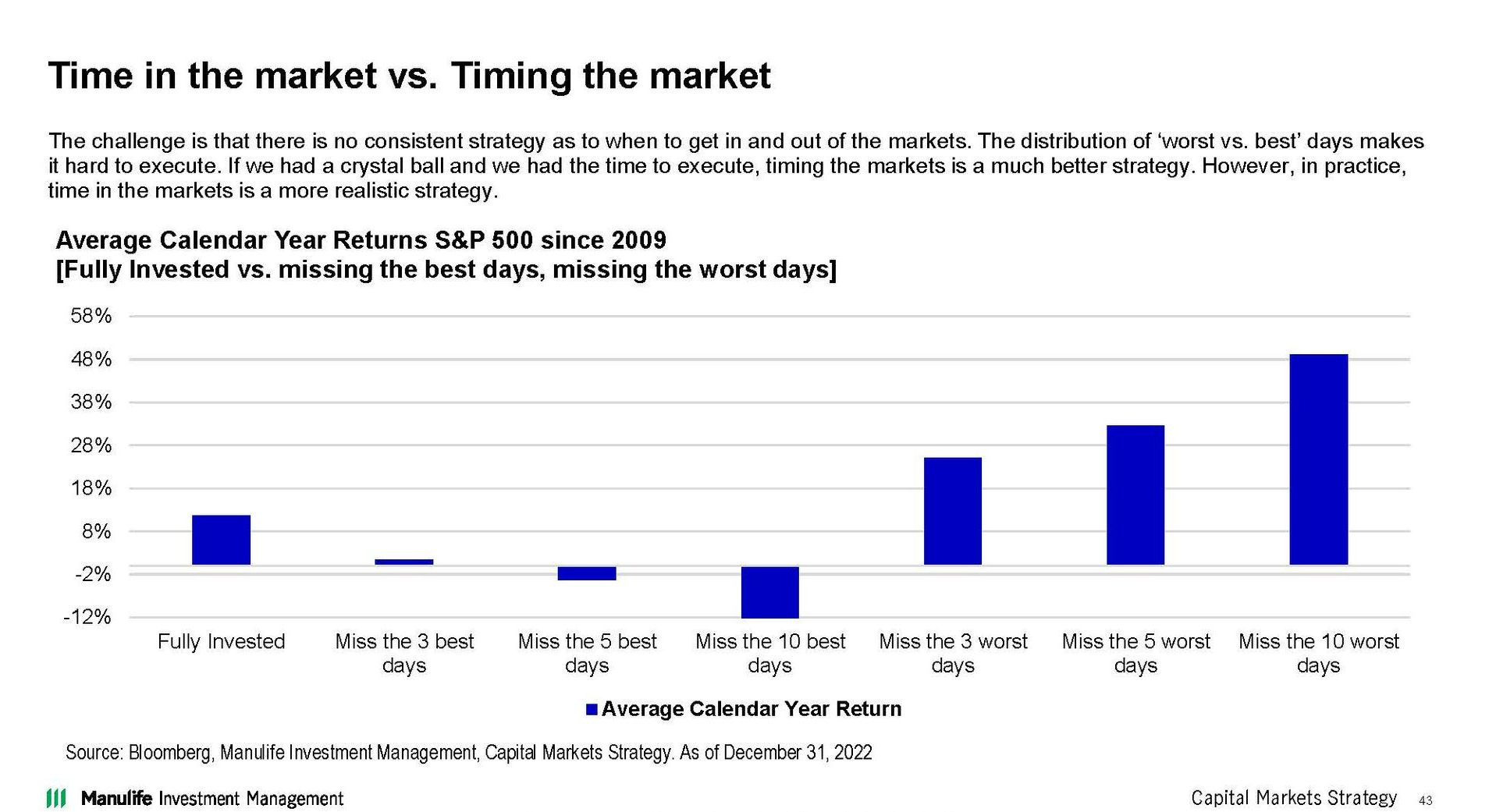

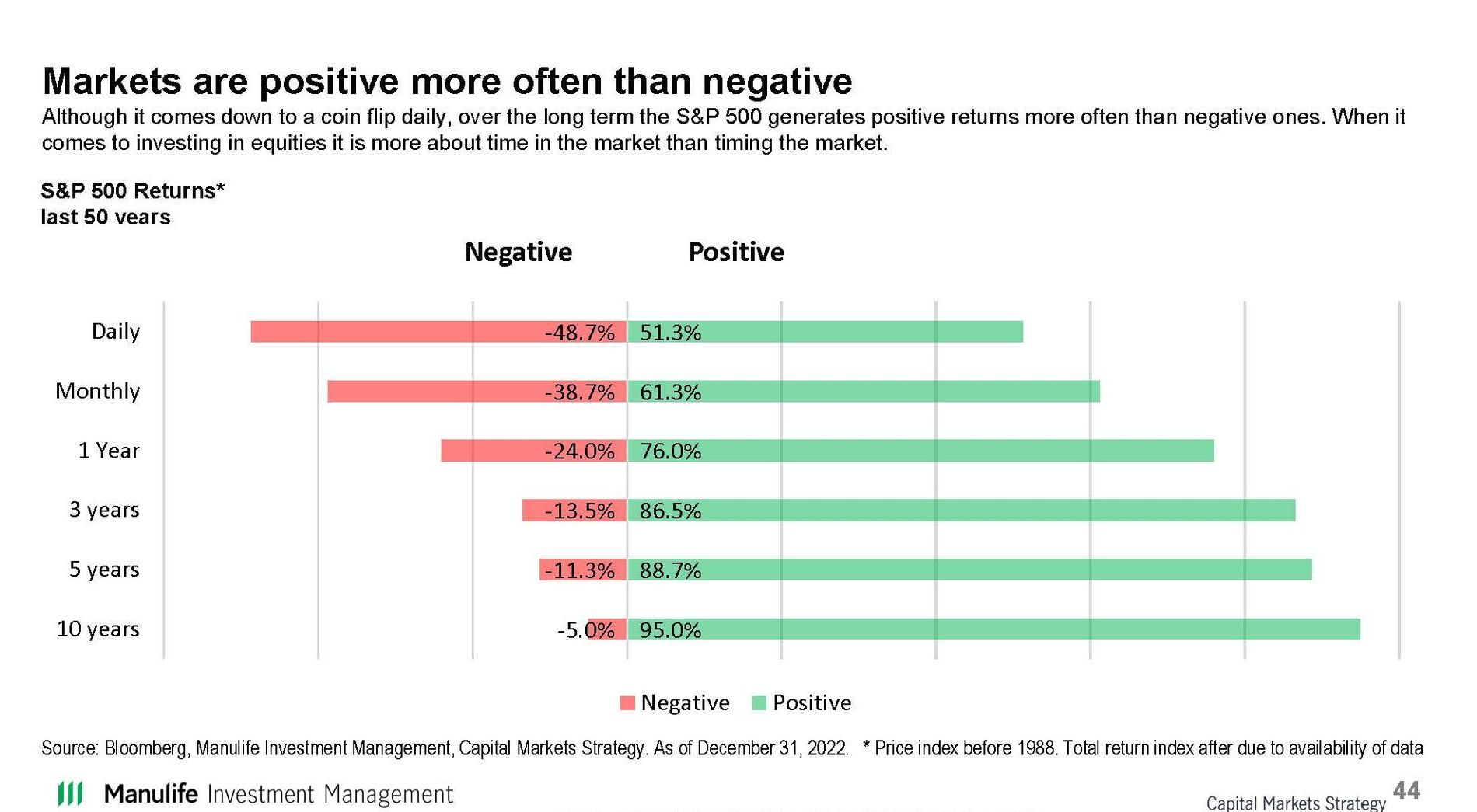

Why would we continue to invest even though we expect a recession and earnings to decrease? Because we never know when the market will recover and if you miss some of the good days it impacts your entire return. So we stay invested (or dollar cost average in with new money) and focus on investments that pay dividends to try to do our best.

In addition a lot of the bad news has been priced in already.

Source: Manulife Investment Management

Fixed income

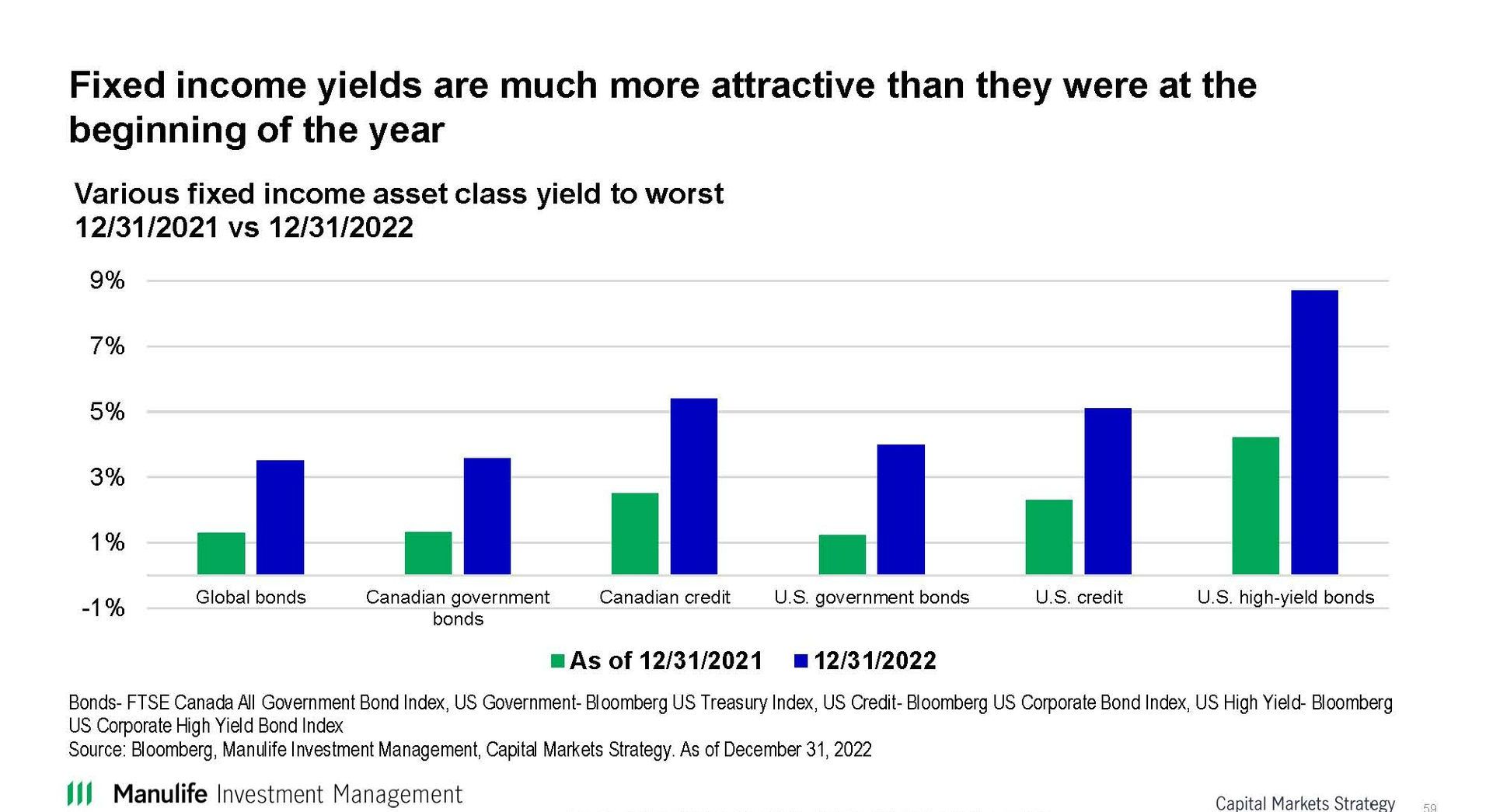

Many bond managers are very excited about the opportunities for bond investing.

One of the managers at Manulife Strategic income said this is the single best time to buy in the last 15 years. Why is that? Because bond prices came down so much last year, there are opportunities for some gains in prices and because yields are so much higher, due to increasing interest rates that they provide a good income source. The yield on Manulife Strategic Income is currently 6% on average with all their holdings.

However, as the economy changes throughout this year, which bonds do better will change so you need to be flexible about what you own.

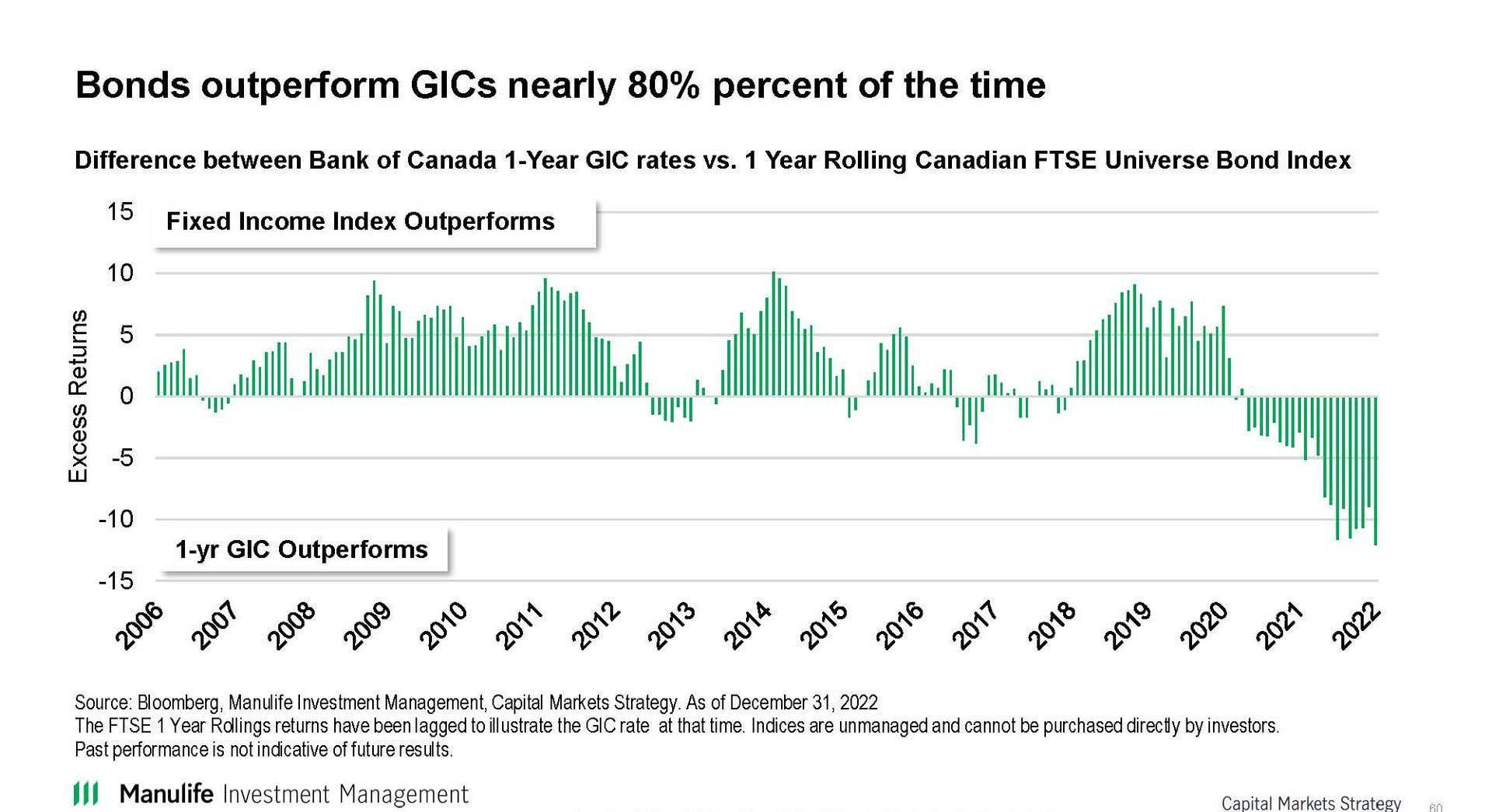

Here is also a chart showing that 80% of the time bonds pay a higher return than GICs, so even with the decent rates available at the banks it is likely better to invest in bonds.

Source: Manulife Investment Management

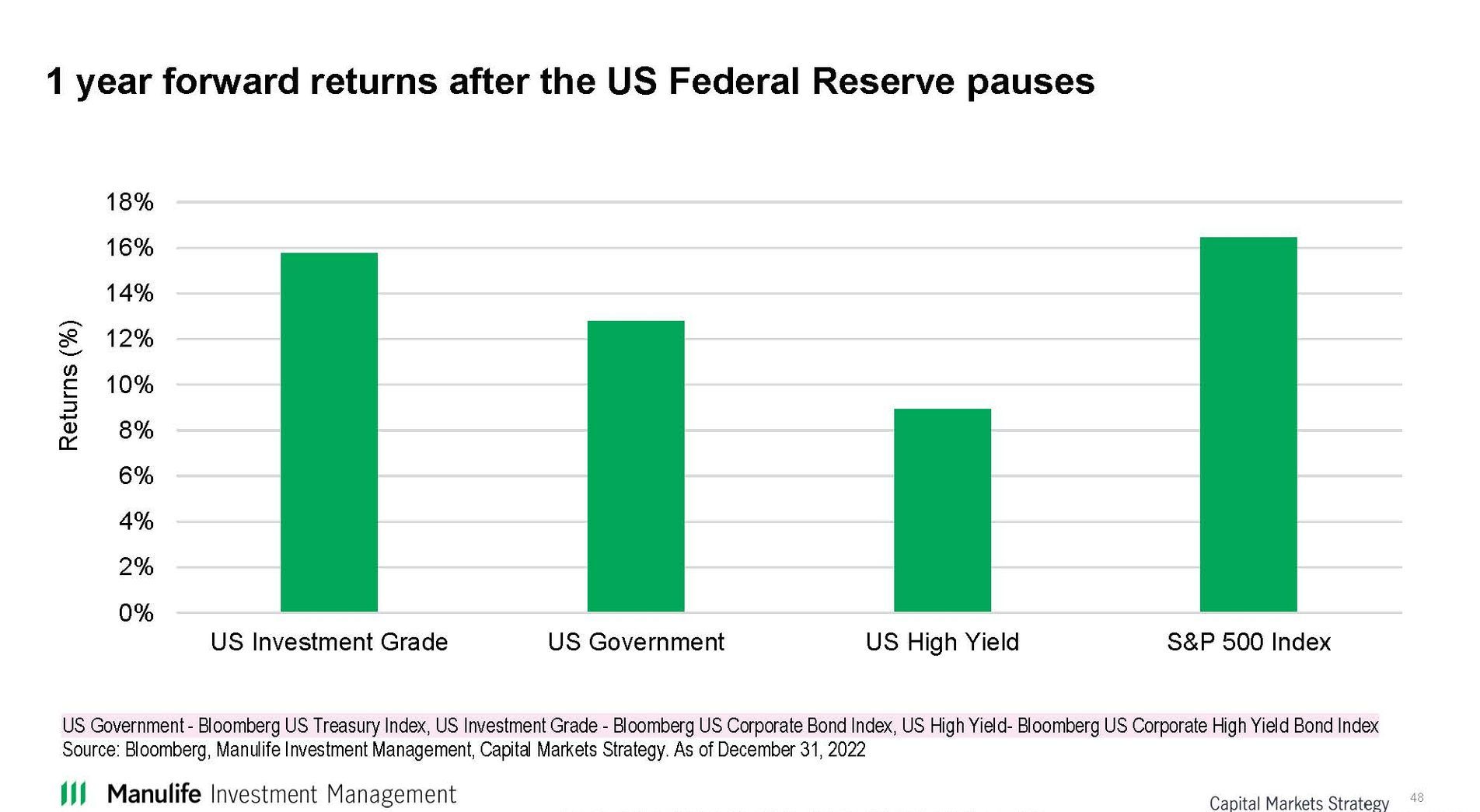

Interest rates

The thought is that the US Federal Reserve and Bank of Canada will stop their interest rate increases sometime between March to May and then pause to see their impact. They are fighting inflation which is slowly coming down. The thought is eventually interest rates will be able to be reduced again but that may take time. Once that happens it is thought stock market returns will be positive as well as bond returns

Final Thoughts

As we settle into a new year with the realization that the global economy is slowing, geopolitical risks remain heightened, inflation is slowly falling, and the Bank of Canada and US Federal Reserve is nearing the end of its interest-rate increases, it can be easy for investors to still feel quite nervous about the state of things. However, despite these setbacks, we think the patient and flexible investor will be rewarded very well in the long.

There’ll be more twists and turns and bumps along the way, but we need to remain focused on the road ahead to make sure we arrive at our destination